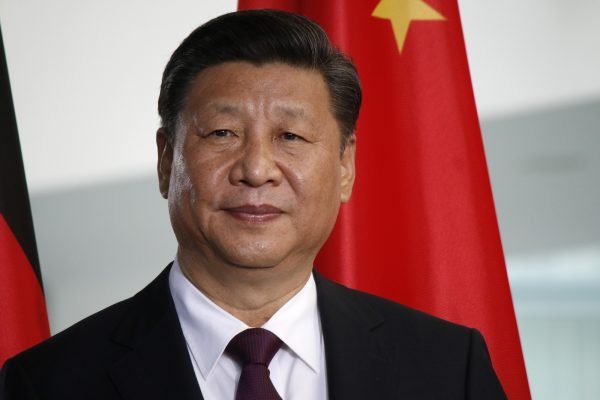

President Xi Jinping is taking center stage in China’s financial industry once again, as he convenes the twice-a-decade Financial Work Conference in Beijing. This high-stakes gathering, postponed for a year due to China’s strict Covid-zero approach, comes at a crucial time for the nation’s political and economic landscape. It will set the tone for the next five years in a financial sector valued at a staggering $61 trillion.

Xi Jinping, often regarded as China’s most powerful leader since Mao Zedong, is expected to emphasize the Communist Party’s “centralized and unified” leadership and heightened scrutiny over the financial sector during this conference. This assertion of control is in line with his ongoing anti-corruption campaign, which has implicated over 100 officials and executives this year.

Financial stability will be another top priority as China aims to shield its banking sector from the woes of a sluggish economy and troubles in the property industry. A debt-laden property sector threatens to rock the financial system, adding urgency to the conference’s agenda.

Bloomberg Intelligence economists suggest that this conference has the potential to be a monumental event for the financial sector, given the pressing challenges it faces. It is no secret that foreign investors have been withdrawing funds from China at an unprecedented rate, partly due to Xi’s crackdown on various segments of the private sector. Wall Street giants, like Goldman Sachs, have scaled back their expansion plans in response.

The conference, first initiated in 1997 in the aftermath of the Asian financial crisis, has grown in importance over the years. The previous conference in 2017 was presided over by Xi himself, highlighting the significance of the event.

Here are the key topics expected to dominate the conference agenda:

1. Party Leadership: Xi Jinping is anticipated to underscore recent changes in the financial industry. Earlier this year, the financial sector underwent an overhaul, leading to the creation of an enlarged national regulator and a shift of some responsibilities from the central bank to a Chinese Communist Party-controlled entity. Xi’s leadership will place the Party’s Central Committee at the forefront of all financial work.

2. Stability & Risks: The conference needs to provide a clear direction for resolving debt problems and preventing a financial crisis. Regulators may opt for stricter oversight to limit moral hazards, especially concerning the nation’s largest banks that have been asked to provide credit support to troubled developers and local government financing vehicles carrying a $9 trillion debt burden. Local governments may be held more accountable for addressing hidden debt and preventing new liabilities.

3. Financial Reform: Although the emphasis is on financial stability, large-scale institutional reforms may not be likely. However, there may be a clearer allocation of responsibilities between the central bank, the National Administration of Financial Regulation, and the China Securities Regulatory Commission, which constitute the financial oversight framework. The functions of the financial stability committee may also be clarified.

4. Serve the Economy: Policymakers may underscore the financial sector’s role in serving the real economy. This could result in a push for increased lending to key industries like high technology, new energy, and environmental protection. Initiatives to boost consumption and service sectors may also be discussed, along with support for sectors like agriculture and rural water projects.

In the context of China’s recent economic indicators, such as a 4.9% GDP growth and a significant jump in retail sales in September, the conference is poised to shape China’s economic future and its role in the global financial landscape. Authorities may also consider further opening up the financial sector and enhancing financial governance to adapt to shifts in the global political and economic environment.